By S.Browne. Updated 3:32 p.m., Friday, December 19, 2025, Atlantic Standard Time (GMT-4).

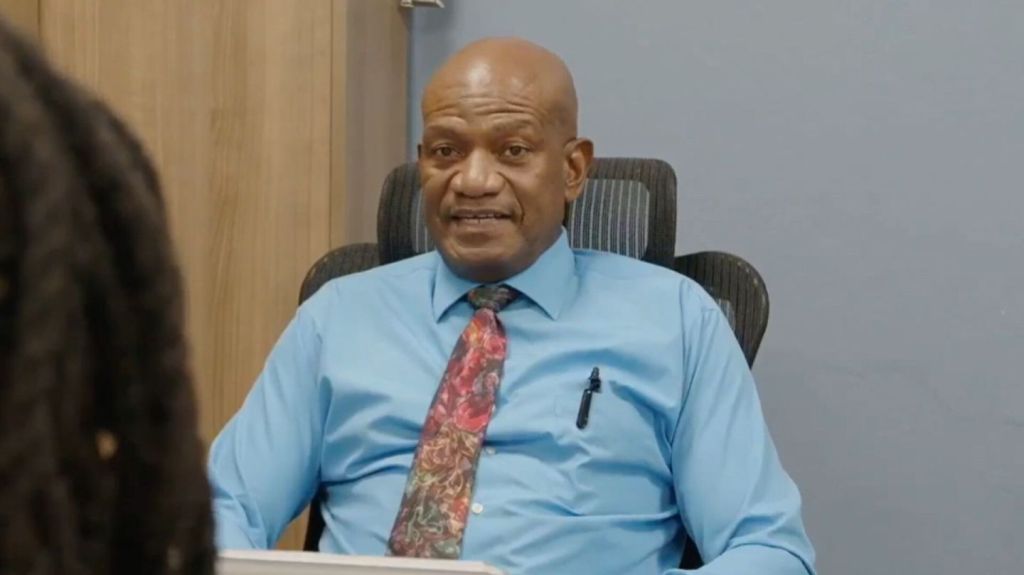

The Inland Revenue Department has reported a successful rollout of VAT-Free Day in St Vincent and the Grenadines. Comptroller Kelvin Pompey said that, so far, businesses registered for VAT have complied with the initiative, passing on savings to consumers.

“We’ve been visiting different business places to see how the VAT is being excluded, ensuring that savings are passed on to the taxpaying public. We have been speaking to business owners and, for the most part, most are complying with the law by not charging VAT today, except on a few items that are excluded, including cigarettes, motor vehicles and arms and ammunition,” Mr Pompey said.

Speaking on the turnout of consumers, Mr Pompey stated: “We are basically quite amazed at the number of persons who are in town. So far from what we are seeing, it’s been a very successful implementation, and I’m confident that the policy makers are quite pleased with the level of enthusiasm from the consumers and the general public.”

When asked what would happen if a VAT-registered business did not comply, Mr Pompey said it is in a company’s best interest to participate. “Any business that charges VAT, for me it’s in their best interest today to go VAT free because it means that other businesses who are not charging VAT would outsell them. So I don’t see the reason why any VAT-registered business would not participate in the VAT-Free Day today,” he said.

Mr Pompey also noted that the initiative applies only to businesses registered for VAT, which are those with annual sales of $300,000 or more. Several teams from the Inland Revenue Department and the Consumer Affairs Division are on the ground to ensure compliance and to verify that VAT savings are passed on to customers.

-END-