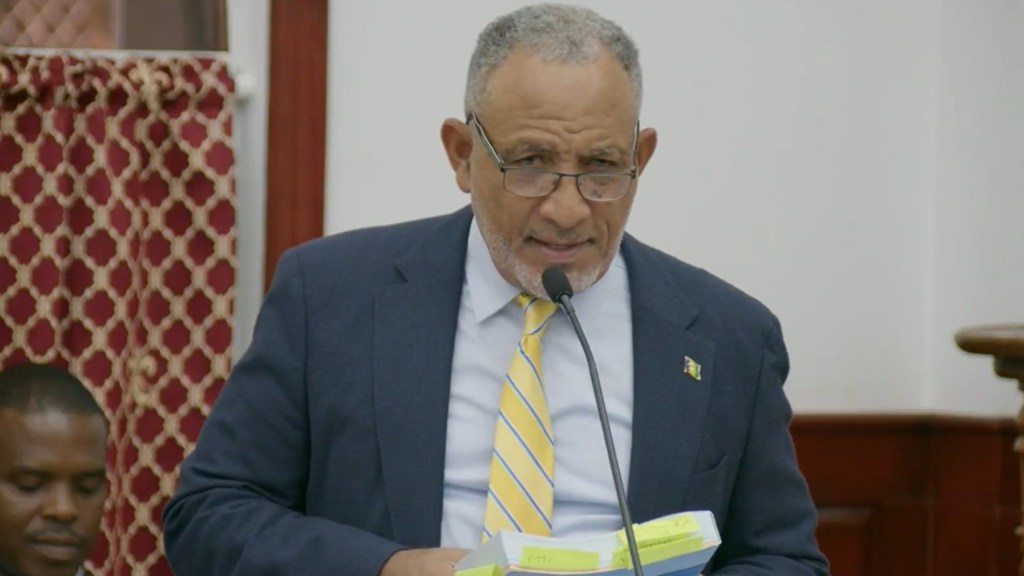

By Val Matthias. Updated 10:45 p.m., Monday, February 9, 2026, Atlantic Standard Time (GMT-4).

Prime Minister and Minister of Finance Dr. Godwin Friday has unveiled a EC$1.9 billion national budget for 2026, assuring Vincentians that the fiscal plan introduces no new taxes even as government spending rises.

Prime Minister Dr. Friday told Parliament that the larger budget will be financed through improved revenue collection, concessional loans, and grants, alongside a re‑established Fiscal Responsibility Framework aimed at reducing deficits and gradually bringing debt down to the Eastern Caribbean benchmark of 60 percent of GDP by 2035.

The Estimates project current revenue at EC$906.9 million, while the capital programme rises to EC$577.3 million, reflecting higher allocations for infrastructure, housing recovery, and climate‑resilient projects. This represents a significant increase from 2025, when current revenue stood at EC$855.6 million and the capital programme was EC$510 million.

Dr. Friday emphasised that the budget is designed to stabilise public finances while protecting households. Relief measures include doubling Public Assistance to EC$500 per month and tax free cost of living support for public employees. Increased allocations to healthcare, education, and vocational training are intended to build human capital and reduce poverty.

“We will not mortgage our children’s future for our present benefit,” Friday declared. “Fiscal discipline is not an end in itself; it is the means by which we create the space to invest, the confidence to grow, and the conditions to employ.”

The near EC$200 million increase over last year’s budget is being managed without new taxes, through strengthened compliance, modernised property tax administration, rationalised import concessions, and targeted expenditure controls that ring‑fence capital spending for productive investment while avoiding recurrent spending increases.

For Vincentians, the absence of new taxes shields them from additional burdens, while expanded social support eases costof living pressures. For the wider economy, higher capital investment is expected to stimulate construction, tourism, and job creation, while infrastructure upgrades from airports and ports to housing recovery will strengthen competitiveness and resilience against disasters. Overall, this can be seen as a shift toward resilience driven development, balancing debt reduction with social protection and long term growth.

END